Cash Rates & Market Updates

February 12, 2024

The 4207 property market has experienced notable shifts in key metrics over the past month.

In this month’s update, we’ll analyse the latest statistics and delve into the implications of the recent RBA cash rate decision on the local real estate scene.

Key Metrics Overview

New Sale Listings:

The number of new sale listings surged to 212 in February, marketing a significant 59.4% increase compared to the previous 30 days.

This influx of listings suggests heightened activity in the market, potentially driven by evolving buyer and seller sentiments.

Average Days on Market:

The average days on market saw a slight uptick, reaching 98.69 days, up by 4.04% compared to the previous 30 days. While properties are spending slightly longer on the market, it’s essential to monitor this trend closely for any potential shifts in demand dynamics.

Average Vendor Discount:

Despite the increase in new sale listings, the average vendor discount decreased to 0.81% down by a significant 22.8% compared to the previous 30 days. This suggests that sellers are becoming more confident in their pricing strategies, potentially indicating a more competitive market environment.

Recently Advised Sales:

The number of recently advised sales saw a modest decline, totalling 89, which is down by 19.82% compared to the previous 30 days. While this decrease may indicate a slight slowdown in transactional activity, it’s essential to consider the broader market context and potential contributing factors.

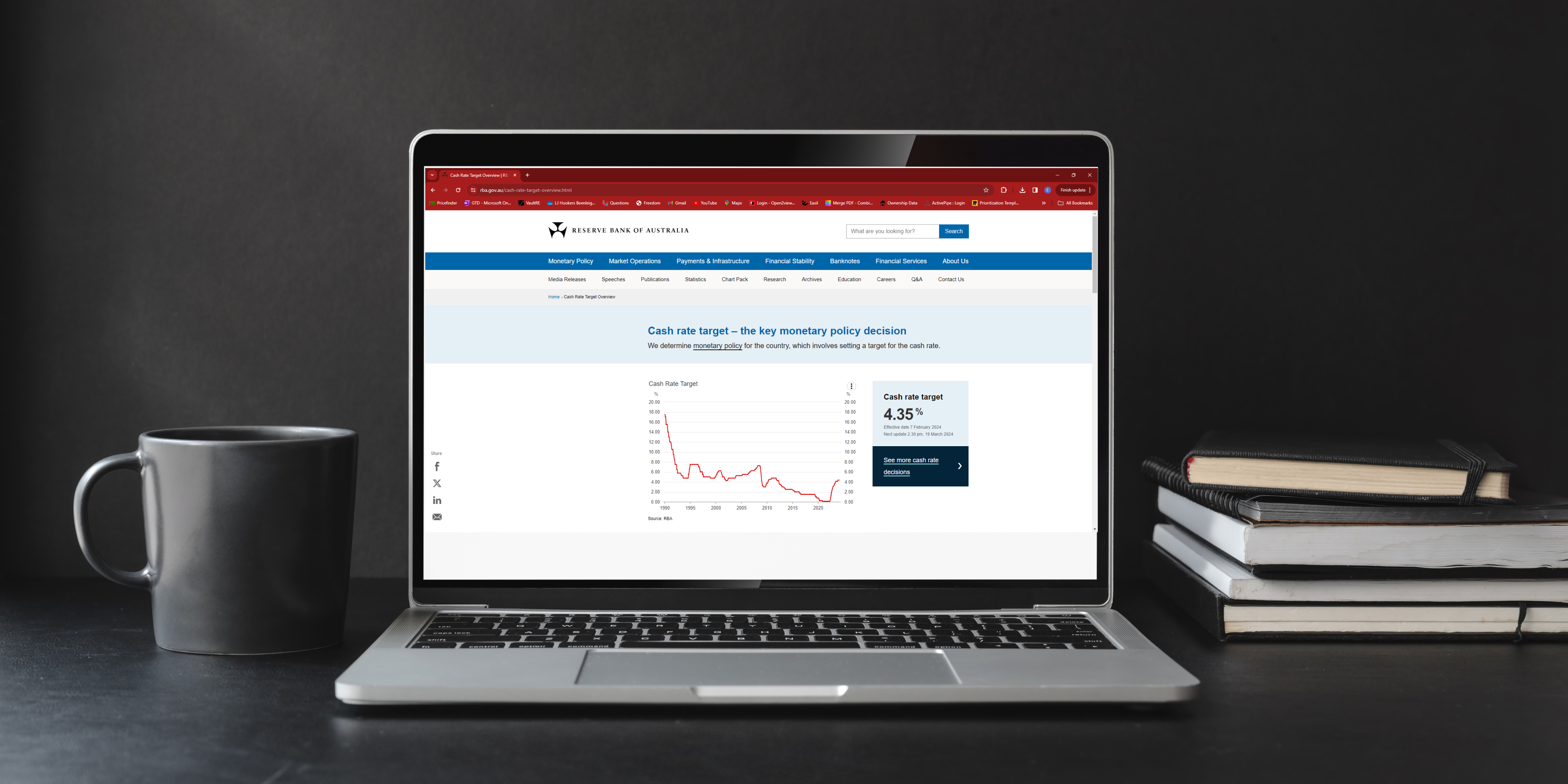

Implications of the RBA Cash Rate Decision

The recent decision by the Reserve Bank of Australia to maintain the cash rate at 4.35% has implications for the 4207 property market. While providing stability, the cautious approach towards future rate movements underscores the uncertainty surrounding economic conditions and potential impacts on the real estate sector.

Research Director Commentary

Insights from research director Tim Lawless shed light on the rationale behind the RBA’s decision. Weak retail trade outcomes, gradual labor market conditions, and a softening in economic activity contribute to the cautious stance. However, the recent slowdown in housing value growth is viewed positively, mitigating risks associated with excessive asset price inflation. 1

Future Outlook

Looking ahead, potential rate cuts later in the year, combined with easing cost of living pressures, may stimulate borrowing capacity and consumer sentiment. This could potentially bolster home purchasing activity in the 4207 market, provided other economic indicators remain favorable.

In conclusion, the 4207 property market is experiencing dynamic shifts in key metrics against the backdrop of the recent RBA cash rate decision. While heightened listing activity and decreased vendor discounts suggest increased market competitiveness, the broader economic context warrants careful monitoring. As we navigate these changes, staying informed and adaptable is paramount for both buyers and sellers alike.

Benjamin Waite | LJ Hooker Beenleigh

This concludes our market report for February 2024. For further insights and personalised guidance, feel free to reach out to your local real estate expert, Benjamin Waite.

Want more insights?

Check out our previous blog posts by clicking the button below!

Leave a Reply