Will the property purple patch continue?

ENQUIRE TODAYThe crystal ball has never been cloudier, however when looking into the future we need to look at recent trends in demand and there are influences that are going to drastically change that.

Main drivers are:

- interest rates

- affordability/wages

- employment

These all seem to look strong and steady.

Interest rates look to remain on hold at least for 2022, this gives confidence to buyers for interim fixed holding costs.

Wages are sitting at 2.2% YoY, not at sustainable 3-4% range the RBA would like them to be hence they are holding firm on interest rates for the immediate future.

Employment is looking very strong with job advertising numbers of 9.9% in November (December had a 5.5% drop to be expected during the holiday season as HR departments take seasonal leave).

What does this all mean for property…

- Interest rates allow us to buy property and pay higher amounts for that same property for the same weekly cost.

- Wages allow us to obtain finance from a lender and employment give us the confidence to spend.

With all these items looking positive, I feel that there is another strong year for property, especially in the entry level markets, such as the Beenleigh Corridor.

There has been a remarkable jump in total house prices, a whopping 14.6% in the month of December, with the break coming quickly buyers were keen to secure something without the stress of hunting over the seasonal break.

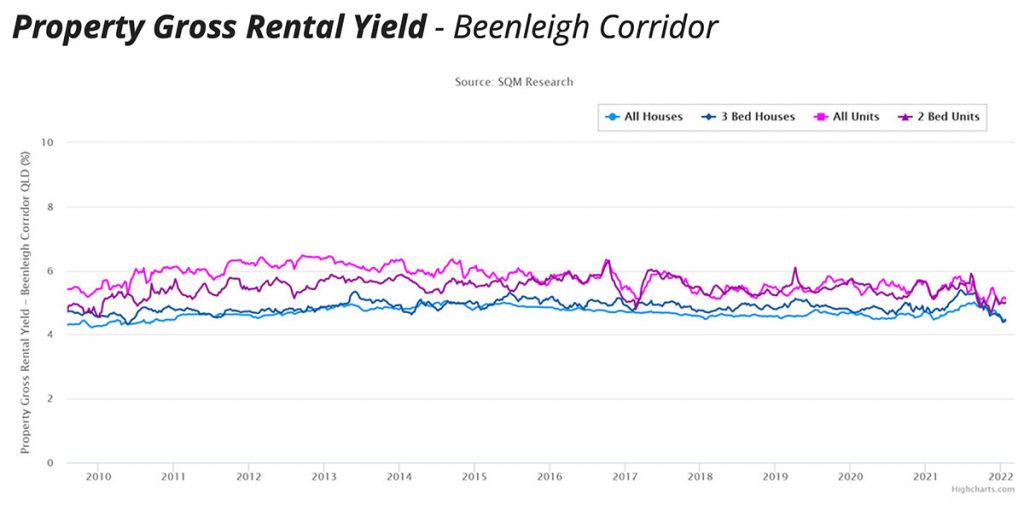

Units have also seen great movement, and long overdue in my opinion with 4.6% movement month on month and 12.5% over the last 6 months. I do feel that housing will start to taper a little as affordability takes its toll, but the winner here will be strata and unit stock as the more affordable prices and higher yields will look more enticing. Don’t forget these units, for the most part, have been built only 10 or so years ago.

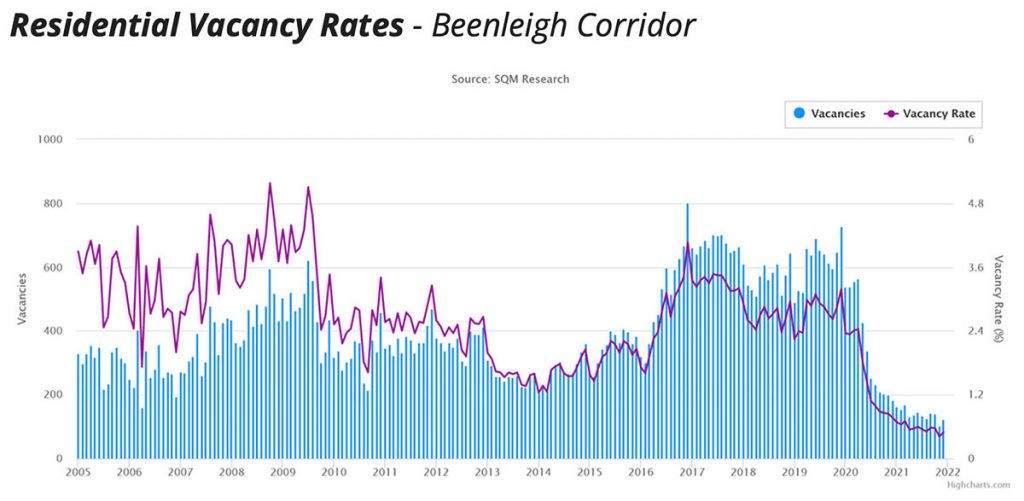

Vacancy rates continue to be at critically low levels (0.7%). However, there looks like there is hope. There has been a large increase in investment purchases of late supported by national investment loan approvals up 3.8% to November and 86.9% YoY.

This has seen an increase of available rentals on the market, nowhere near enough to quench the rental demand but heading in a better direction.

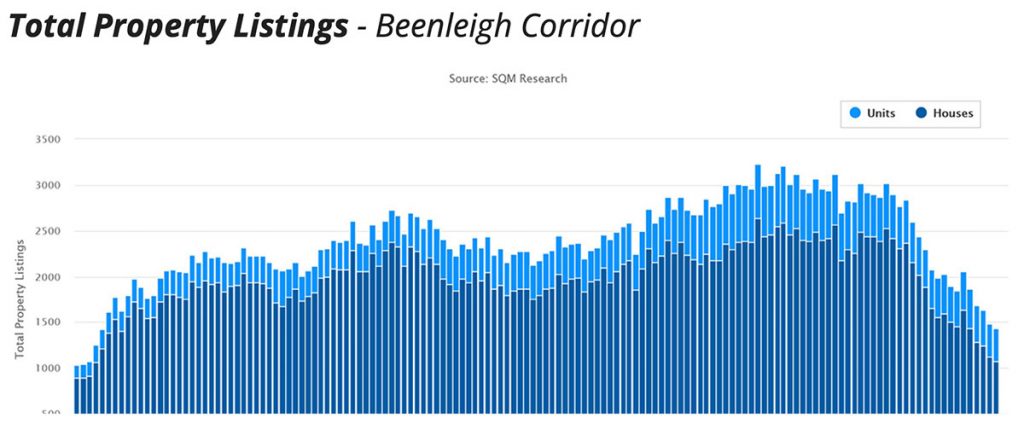

Stock availability has been downward trending more than -67.2% over the past 6 months with very little properties sitting on the market between 60 to 180 days. Properties are being sold as quickly as they are listed.

Total properties listed in Dec were up 2% MoM however at the 2021 year there is 81% less stock on the market when comparing December ’21 and January ’21.

As detached housing starts to plateau and rental asking prices catch up with purchase prices housing yields have increased by .1% to 4.7%. Strata and Unit yields have dropped -3.6% MoM, the major downward movement in this sector contributed to purchase price increases at a higher rate than rental increases.

This is caused by heightened demand to buy and due to rental prices being less dynamic because many rentals are in fixed term arrangements.